At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Sweden raises USD 3 billion in a three-year bond at 1.218 %

Press release 13 October 2016

Kingdom of Sweden raised USD 3 billion (approximately SEK 26 billion) in a new three-year benchmark at a yield of 1.218 per cent. The proceeds will be used to refinance loans to the Riksbank.

The transaction was priced at mid-swaps plus 6 basis points. More than 70 investors took part with the total bid volume exceeding USD 3 billion.

– There was a great demand for our bonds and the market conditions were positive. This enabled us to price the issue at a favourable level. We are pleased to see that the bond was placed with a large number of investors around the world, says Maria Norström, Head of Funding at the Swedish National Debt Office.

| Issuer |

Kingdom of Sweden |

|---|---|

| Size |

USD 3 billion |

| Coupon |

1.125 % s.a. |

| Maturity date |

21 October 2019 |

| Price |

99.727 % |

| Yield |

1.218 % s.a. |

| Spread versus USD mid swaps |

6 basis points |

| Spread versus US benchmark |

20.45 basis points |

| Lead managers |

Barclays, Goldman Sachs, HSBC, SEB |

The Debt Office plans to sell foreign-currency bonds for a total of SEK 59 billion in 2016.Today’s transaction, which was the third one this year, completes the funding in foreign-currency bonds this year for the Riksbank.

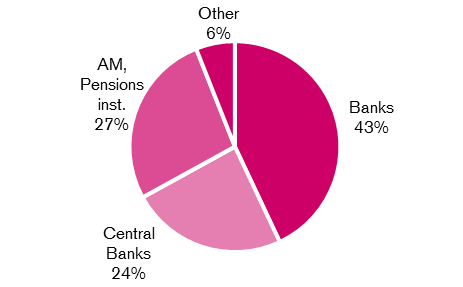

Distribution by investor

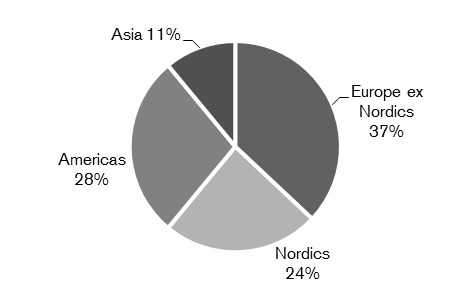

Distribution by region

Contact

Johan Bergström, Funding Manager, +46 (0)8 613 45 68