At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

What governs the size of central government debt?

The size of central government debt is mainly affected by political decisions and macroeconomic developments.

Politicians can, among other things, decide on tax rates, either the introduction of new taxes or changes to existing ones, such as income tax. Economic developments then govern whether incomes increase a little or a lot, and thereby how much tax is actually paid. In the same way, politicians can decide on different types of expenditure, such as unemployment insurance, the amount of which is then affected by trends in the number of unemployed.

What is a reasonable government debt?

It is difficult to point out an optimal level. The amount of government debt is ultimately a political issue, but economic considerations can provide guidance as to why it should not be too high or too low.

The socio-economic costs associated with debt crises caused by excessive indebtedness are both more serious and more common. Research has therefore focused to a great extent on possible problems with a large government debt. This applies, for example, to the risk of rising interest costs and lower economic growth when the debt exceeds a certain threshold. However, the research results are uncertain as to such a threshold, although around 80 per cent of GDP can be an approximate benchmark.

Central government debt – a shock absorber in the economy

Any problems with a low level of government debt are mainly linked to the conditions for a market for government bonds. The interest rate on government bonds fulfils an important function as a reference rate in the economy and in financial markets. Among other things, the government borrowing rate that is used to calculate certain tax bases for both companies and individuals.

No matter where the limit for excessive government debt is placed, there are two important economic reasons for keeping a good margin to it:

- Firstly, one of the most important tasks for government debt is to act as a shock absorber in the economy during economic fluctuations. In a recession, for example, the government's need to borrow money increases. Tax revenues are falling and expenses of, for example, unemployment benefit are higher. Correspondingly, the government's borrowing needs decrease in a boom.

- Secondly, financial and economic crises in a country are generally very costly. That is why there should be fiscal breathing space in order to cope in a crisis. Historical experience shows that room to double the government debt can be a rule of thumb.

The fiscal framework

The budgetary policy objectives consist mainly of four parts:

- a surplus target for the entire public sector

- a debt anchor for the public sector

- an expenditure ceiling for the government

- requirements for local and county authorities for good economic housekeeping and balance in the budget

The surplus target is an objective for public sector financial saving and is expressed as a certain percentage of gross domestic product (GDP) over an economic cycle. The new framework applied from the financial year 2019 reinforces the follow-up of the surplus target by focusing more clearly on a comparison between the surplus target and so-called structural saving. Structural saving is an estimate of how large the financial saving would be if it were not affected by the cyclical situation or one-off effects in financial policy.

A debt anchor has been introduced

The new framework has a debt anchor. This is a benchmark for what the medium-term size of the consolidated gross debt should be. It is the consolidated debt of the entire public sector (the government and local and county authorities) and is also called the Maastricht debt. The debt anchor that is determined is that gross debt shall be 35 per cent of GDP.

According to the Budget Act, it is mandatory for the government to propose a ceiling for government and retirement pension system expenditure for three years. Thereafter, the Riksdag establishes the ceiling. This decision makes it clear which frameworks exist for expenditure and taxation in order to reach the surplus target.

Since 2000 there has been a balance requirement for the local government sector. The requirement means that each municipality and county council shall budget for a balanced result. The balance requirement indicates the lowest acceptable result level. Since 1992, municipalities and county councils have been required to have guidelines for good economic management in their operations.

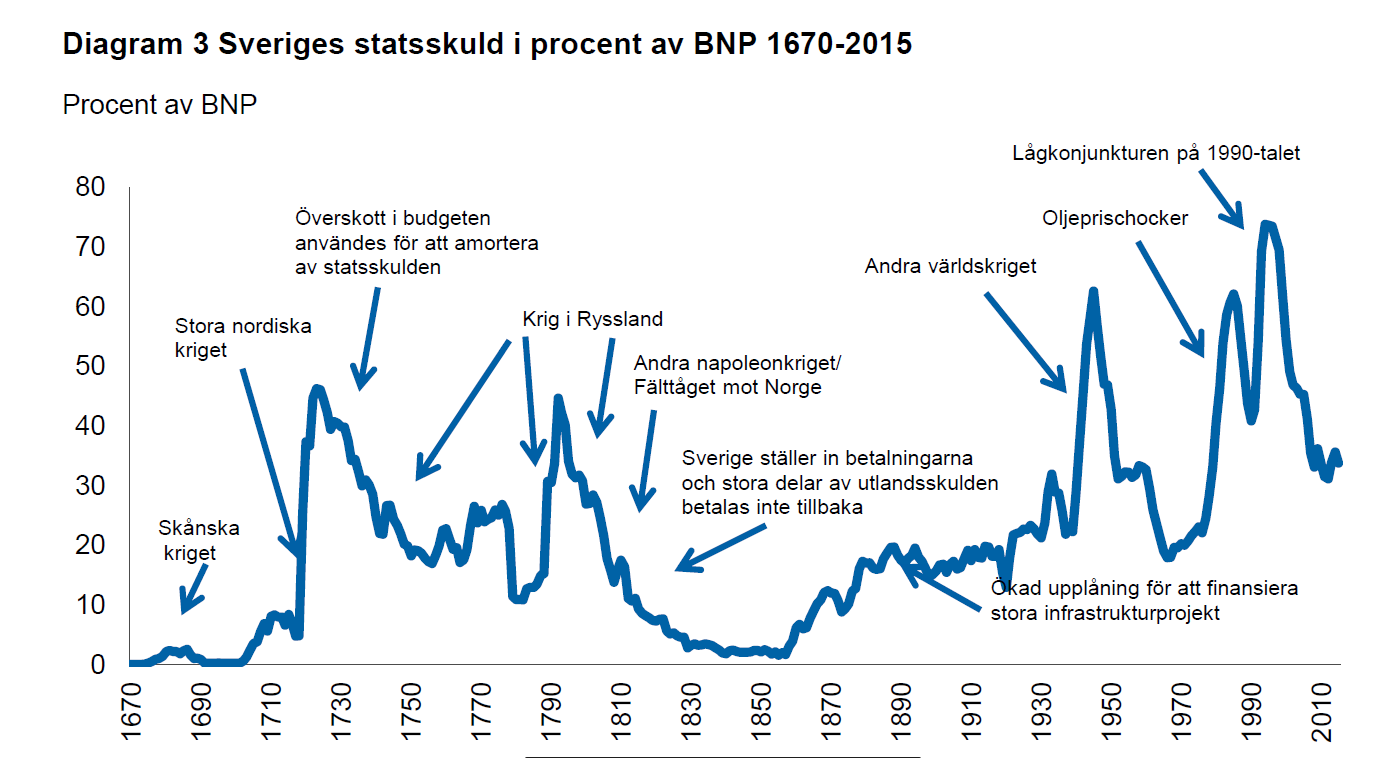

Central government debt through history

The central government debt has varied throughout history for various reasons.

Statistics on the central government debt

Want to learn more? See statistics on the development and composition of the central government debt.