At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

The central government payment model

We are responsible for the central government payment model and for ensuring that it is effective. A key part of the payment model is that we use commercial banks and existing infrastructure.

Consequently, one important task is to procure framework agreements for payment services. Government agencies are obligated to use these agreements and are not allowed to use other banking services or other banks without our permission.

Government agencies' use of our agreements is stipulated by the Government. We procure three framework agreements: Payment Services, Card and Travel Account services, and Prepaid Card.

The framework agreement for payment services specifies how the cash pool-structure is set up within the framework agreement banks. It specifies other rules and requirements that the banks must comply with to ensure perfect centralised liquidity management (liquidity settlement).

The framework agreement also specifies all services and conditions including prices. Thus, the agencies do not have to negotiate with the banks, which entails substantial administrative benefits.

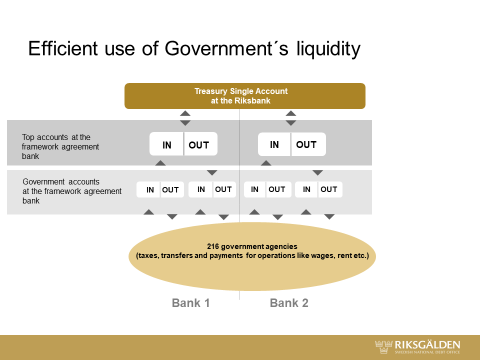

The cash pool structure

We have arranged a special account structure within the three framework agreement banks (Danske Bank, Nordea and Swedbank) – a cash pool. The aim is to ensure the efficient use of Government’s liquidity.

The first level consists of the agencies' bank accounts, for all their payments such as taxes, transfers, wages, rent etc. The second level consists of the top accounts at the framework agreement banks. The third level consists of our Treasury Single Account (TSA) at the Riksbank, the Swedish central bank. The TSA is one of the cornerstones of our model.

Three times a day, the banks sweep the agencies' bank accounts. All liquidity is collected into the banks' top accounts. The net sum is settled with our TSA. This means that three times a day, all liquidity is pooled in our TSA, and the agencies' accounts are set at zero overnight.

The model is effective due to the use of the commercial bank infrastructure; lower liquidity requirements with concentrated payment flows; mandatory framework agreements and concentrated expertise.