At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden raises USD 1 billion in 3-year bonds at 1.041 %

Press release 29 September 2015

Kingdom of Sweden issued USD 1 billion (approximately SEK 8.4 billion) in a new three-year benchmark at a yield of 1.041 per cent.

The transaction was priced at mid-swaps plus 4 basis points and is the first three-year deal after several weeks of difficult market conditions with pronounced volatility. Close to 40 investors took part with bids exceeding USD 1.5 billion.

– Despite the turbulent financial environment we saw very strong support from dollar investors even this time, says Maria Norström, Head of Funding at the Swedish National Debt Office.

|

Issuer |

Kingdom of Sweden |

|

Size |

USD 1 billion |

|

Coupon |

1 % s.a. |

|

Maturity date |

5 October 2018 |

|

Price |

99.879 % |

|

Yield |

1.041 % s.a. |

|

Spread versus USD mid swaps |

4 basis points |

|

Spread versus US benchmark |

10.75 basis points |

|

Lead managers |

Barclays, Citigroup, J.P. Morgan |

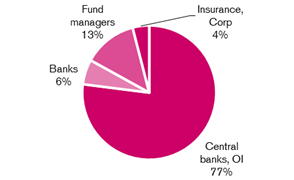

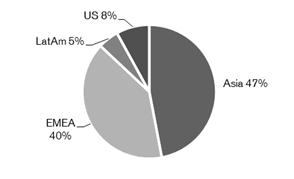

Distribution by investor and region

With today’s transaction, the planned funding in foreign currency bonds for the whole of 2015 has been carried out.

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77