At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden issues a 5-year dollar benchmark

Press release 17 March 2015

Kingdom of Sweden issues USD 1.75 billion (approximately SEK 15 billion) in a new five-year bond at a yield of 1.667 per cent. The proceeds will be used for the central government.

The transaction was priced at mid-swaps minus four basis points. It is the first five-year syndicated sovereign dollar benchmark to price through mid-swaps so far this year.

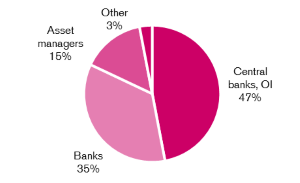

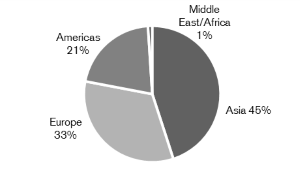

– It was interesting and pleasant to see such broad distribution both geographically and by type of investor, says Maria Norström, Head of Funding.

| Issuer |

Kingdom of Sweden |

|---|---|

| Size |

USD 1.75 billion |

| Coupon |

1.625 % s.a. |

| Maturity date |

24 Jan 2020 |

| Price |

99.799 % |

| Yield |

1.667 % s.a. |

| Spread versus USD mid swaps |

Minus 4 basis points |

| Spread versus US benchmark |

12.1 basis points |

| Lead managers |

Barclays, Credit Suisse and HSBC |

In 2015, the Debt Office plans to issue foreign currency bonds equivalent to SEK 93 billion. The volume includes refinancing of on-lending to the Riksbank equivalent to SEK 53 billion. After today’s transaction approximately SEK 31 billion remains.

Distribution by investor and region

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77