At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden issues a 3-year dollar benchmark

Press release 15 January 2015

Kingdom of Sweden issues USD 2.5 billion (approximately SEK 20 billion) in a new three-year bond at a yield of 0.962 per cent. The proceeds will be used to refinance maturing on-lending to the Riksbank.

The transaction was priced at mid-swaps minus 6 basis points and is the first European sovereign issue in dollar this year. Over 40 investors took part in the deal.

– Despite a significant volatility in the fixed income and FX markets as well weakness in equities, we could price flat to our secondary curve, says Maria Norström, Head of Funding.

|

Issuer |

Kingdom of Sweden |

|

Size |

USD 2.5 billion |

|

Coupon |

0.875 % s.a. |

|

Maturity date |

23 Jan 2018 |

|

Price |

99.743 % |

|

Yield |

0.962 % s.a. |

|

Spread versus USD mid swaps |

Minus 6 basis points |

|

Spread versus US benchmark |

15.3 basis points |

|

Lead managers |

Barclays, Citigroup, Nordea |

In 2015, the Debt Office plans to issue foreign currency bonds equivalent to SEK 97 billion. The volume includes refinancing of on-lending to the Riksbank equivalent to SEK 57 billion.

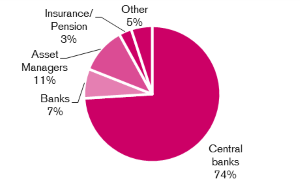

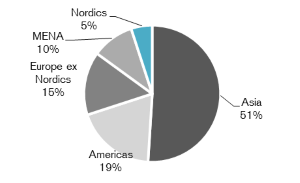

Distribution by investor and region

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77