At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden issues 3-year dollar benchmark

Press release 6 May 2015

Kingdom of Sweden issues USD 2.25 billion (approximately SEK 19 billion) in a new three-year bond at a yield of 1.136 per cent. The proceeds will be used to refinance maturing on-lending to the Riksbank.

The transaction was priced at mid-swaps minus 10 basis points, which is the lowest level for the Kingdom of Sweden in a 3-year dollar bond since 2012. Over 50 investors took part in the deal with bids totalling USD 3.3 billion.

– Despite volatile fixed-income and FX markets, demand from investors was significant, says Maria Norström, Head of Funding at the Swedish National Debt Office.

|

Issuer |

Kingdom of Sweden |

|

Size |

USD 2.25 billion |

|

Coupon |

1.125 % s.a. |

|

Maturity date |

15 May 2018 |

|

Price |

99.968 % |

|

Yield |

1.136 % s.a. |

|

Spread versus USD mid swaps |

–10 basis points |

|

Spread versus US benchmark |

14.5 basis points |

|

Lead managers |

Citigroup, HSBC, Nordea |

In the latest forecast from February, the Debt Office planned for total borrowing in foreign-currency bonds of SEK 93 billion in 2015. After today’s transaction approximately SEK 10 billion remains.

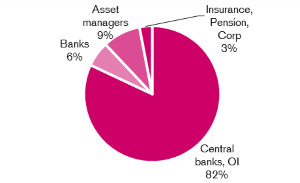

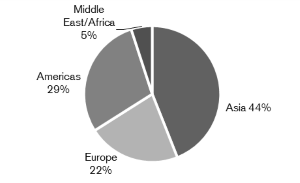

Distribution by investor and region

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77