At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden issues a 3-year dollar benchmark

Press release 4 November 2014

Kingdom of Sweden issues USD 3 billion (approximately SEK 22 billion) in a new three-year bond at a yield of 1.077 per cent. The proceeds will be used to refinance maturing on-lending to the Riksbank.

The transaction was priced at mid-swaps minus 7 basis points. No sovereign issuer has so far this year been able to price as tight to the swap curve in dollar, US treasury excluded. It is also the lowest level the Kingdom printed dollar at since 2012. The orderbook almost reached USD 4 billion.

– The demand for our bonds is significant despite their richness. The bond was even priced flat to Sweden’s secondary curve, says Maria Norström, Head of Funding.

|

Issuer |

Kingdom of Sweden |

|

Size |

USD 3.0 billion |

|

Coupon |

1 % s.a. |

|

Maturity date |

13 Nov 2017 |

|

Price |

99.773 % |

|

Yield |

1.077 % s.a. |

|

Spread versus USD mid swaps |

Minus 7 basis points |

|

Spread versus US benchmark |

14.3 basis points |

|

Lead managers |

Barclays, Citigroup, HSBC, Nordea |

This year’s planned total funding in foreign currency bonds equivalent of SEK 83 billion has now been covered and concluded.

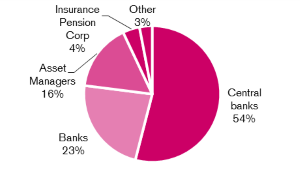

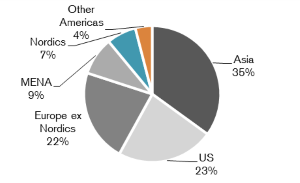

Distribution by investor and region

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77