At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Resolution planning

Effective financial crisis management requires extensive planning and preparation. The Debt Office plans extensively in order to maintain the readiness for managing a bank or other institution that encounters a crisis.

As a basis for its banking-crisis management planning, the Debt Office relies on regulatory frameworks, as well on policies and methods that the agency has developed.

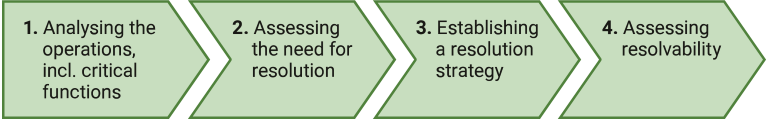

The Debt Office’s planning process involves assessing whether an institution in crisis should be managed through resolution and, if so, how this is to be done and whether it can be carried out in an orderly manner. The process can be divided into four stages, see below.

The Debt Office only plans for resolution for the institution in question if it considers that its bankruptcy or liquidation could lead to a serious disruption of the financial system.

Planning process

For a detailed description of the different stages of the planning process, click on the plus sign.

Significance to the financial system is the deciding factor

We conduct crisis planning for all banks and financial institutions regardless of whether they are critical to the functioning of the financial system in Sweden or not. However, the planning for a systemically important institution is much more extensive than that for an institution not deemed to have a significant impact on the system. The effects of a systemically important institution’s failure could spread to other parts of the financial system and result in major consequences. To prevent that from happening, systemically important banks and institutions can be put into resolution.

The resolution plan includes, among other things, the following assessments:

- Does the bank or institution have critical operations such as large volumes of deposits and lending?

- Which resolution tools and measures shall be applied? If the institution is part of a group, in what part of the group are the measures to be implemented? Examples of such measures include the Debt Office selling all or part of the operations, or that liabilities are written down or converted into new equity.

- What level of resources in the form of capital and eligible liabilities is the bank required to hold? We set a requirement for the volume of such resources that each bank must hold. This is called MREL (minimum requirement for own funds and eligible liabilities). It is to ensure that the bank has sufficient resources to enable the Debt Office, if needed, to perform a bail-in, which is one of the resolution tools.

Having a well-thought-out strategy in advance means that we can begin crisis management straight away. Taxpayers shall always be protected.

Simplified planning for smaller institutions

Less extensive planning is required for institutions that the Debt Office considers suitable to be managed through bankruptcy or liquidation without any significant impact on the financial system or the broad economy. Certain parts of the planning for such institutions can be less elaborate or eliminated entirely, and the planning does not need to be updated as frequently.

The possibility for the Debt Office to use simplified planning is based on rules other than those governing the planning process for resolution. The considerations to be made according to the rules for simplified planning use a quantitative model with fixed thresholds for when simplified planning may not be applied. This means that cases can arise in which an institution – despite having been deemed suitable for bankruptcy or liquidation – can nevertheless be subject to simplified planning.

The Debt Office’s determination of whether simplified planning is appropriate for an institution is made as follows:

-

First, a quantitative assessment is performed based on the O-SII score that Finansinspektionen (the Swedish Financial Supervisory Authority) calculates as part of its oversight and evaluation of an institution’s importance to the financial system. Institutions with an O-SII score above 105 are not eligible for simplified planning.

- For institutions with an O-SII score below 105, a supplementary qualitative assessment is subsequently performed. If this assessment shows that the institution can be wound up through bankruptcy or liquidation with no significant impact on the financial system or the broad economy, simplified planning is used.

The planning is summarised in resolution plans

The planning for all institutions, irrespective of whether they are to be managed through resolution or by being put into bankruptcy or liquidation, is encapsulated in a resolution plan for each institution. For the institutions that the Debt Office intends to manage through resolution, the plans are updated annually. As a starting point, the Debt Office makes decisions on these plans every year in December.

For institutions that we consider suitable to be wound up through bankruptcy or liquidation and that are subject to simplified planning, the plans are significantly less comprehensive and the resolution plans are updated and established every third year.

Banks and institutions report information

In order for the Debt Office to prepare for effective crisis management and develop resolution plans, certain information is required from the banks and institutions. All banks and institutions subject to the regulations, including those that are not systemically important, are required to submit the information we need to draft resolution plans.

Information for banks and institutions that shall report information

List of banks and institutions in scope

Finansinspektionen (the Swedish Financial Supervisory Authority) provides a list of the companies covered by the Resolution Act (2015:1016). The list comprises a wide range of categories of firms. However, only financial institutions on the list, e.g. joint-stock banks, savings banks, member banks, credit market companies, and investment firms, are subject to reporting obligations.