At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Sweden raises USD 3 billion in a five-year bond at 2.452 %

Press release 9 January 2018

Kingdom of Sweden raised USD 3 billion (approximately SEK 24 billion) in a new five-year benchmark at a yield of 2.452 per cent. The proceeds will be used to refinance loans to the Riksbank.

The transaction was priced at mid-swaps 12 basis points. More than 80 investors took part with the total bid volume of USD 7.5 billion.

– It is a great start of the year for the Kingdom. Both volume and geographical distribution illustrated strong investor demand, says Anna Sjulander, Head of Funding at the Swedish National Debt Office.

| Issuer |

Kingdom of Sweden |

|---|---|

| Size |

USD 3 billion |

| Coupon |

2.375 % s.a. |

| Maturity date |

15 February 2023 |

| Price |

99.632 % |

| Yield |

2.452% s.a. |

| Spread versus USD mid swaps |

12 basis points |

| Spread versus US benchmark |

16.2 basis points |

| Lead managers |

BMO Capital Markets, Goldman Sachs International, HSBC and Nordea |

In 2018, the Debt Office plans to issue bonds in foreign currency equivalent to SEK 102 billion. The funding refers to refinancing of bonds previously raised on behalf of the Riksbank. After today’s transaction, approximately SEK 78 billion remains.

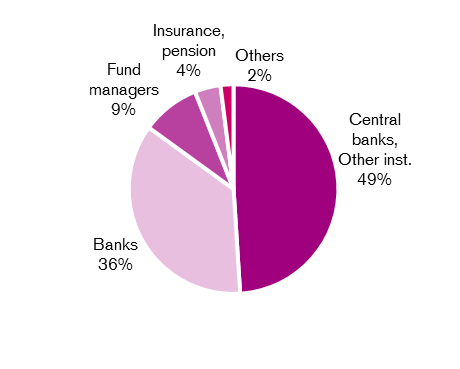

Distribution by investor

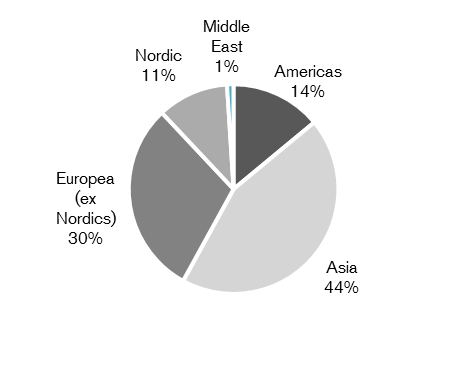

Distribution by region

Contact

Johan Bergström, Funding manager, +46 (0)8 613 45 68